Binary trading – why do you need a broker?

Intrigued by binary options trading, an average person who registers a trading account with a broker might take it for granted. And perhaps they don’t even wonder why they need a broker at all, or what function the broker performs in the trading of binary options. They also pay little attention to the differences that exist between the various brokerage firms. We want to lift the veil on this information a little and provide at least a minimal explanation of why the client needs a broker.

So, what is a binary options broker? Most citizens of the former Soviet Union, having grown up on anti-capitalist propaganda, poorly understand the structure of the global financial market. Their understanding of a broker is a person who, working in some hypothetical office on Wall Street, is waving their hands frantically and committing fraud for a large profit. Yes, perhaps that’s how it once was. But we live in the age of information technology, and we’re talking about trading binary options. Therefore, in this embodiment, the broker is primarily a legal entity, a company that provides you with access to the financial market, in which the trader, you, carries out operations independently. A binary options broker should be considered a company that provides brokerage services. This is quite a significant difference. The fact is, brokers can be divided into two categories – brokers carrying out transactions on behalf of clients and with the client’s funds, and the second are brokers who carry out operations on their own behalf, but at the expense of their clients. The second category is often large financial corporations, in which clients are investors and receive a percentage of the total profit of the company. But the first option is precisely those companies, whose services we use for binary trading. Let’s take the Binomo broker as an example:

By registering a trading position, you are simply submitting a request to have a transaction opened on the financial market on your behalf. The company can finalize your contract on the market, as brokers are licensed and accredited by stock exchanges. Of course, if we consider these companies as classic brokerage firms, we should say that in the way they are used by private traders, they are more like dealing centers that collect requests to trade and conclude them on the market. At the same time, the company’s earnings consist of a small commission from your turnover that you don’t even notice, as it is included in the profitability percentage of the option contract.

How do brokers differ

This question can be discussed endlessly, so we’ll focus on the key indicators worth exploring so that you don’t run into scams or so-called “kitchens” – companies that don’t conclude positions on the market, rather, trading takes place between traders and clients of the company.

- First of all, a normal broker always has a license to engage in financial transactions on the market. In Russia, this license is from the FMRRC regulator. The Binomo broker, which we took for our example, has this license. But here we have to double check, because information about having a license is not a guarantee of its existence in reality (there have been cases of forgery). So, you should double check the license on the regulator’s site

- Secondly, a normal broker in their terms of service will not require you to deposit a large amount of funds in your trading account. If you see that the company gives access to the market only with a deposit of 250-300 dollars and higher, then you should run away immediately. Even if you earn something there, it will be impossible to monetize your profits. Let’s return to our example – the Binomo broker: here trading starts at $10, which already inspires confidence in the company

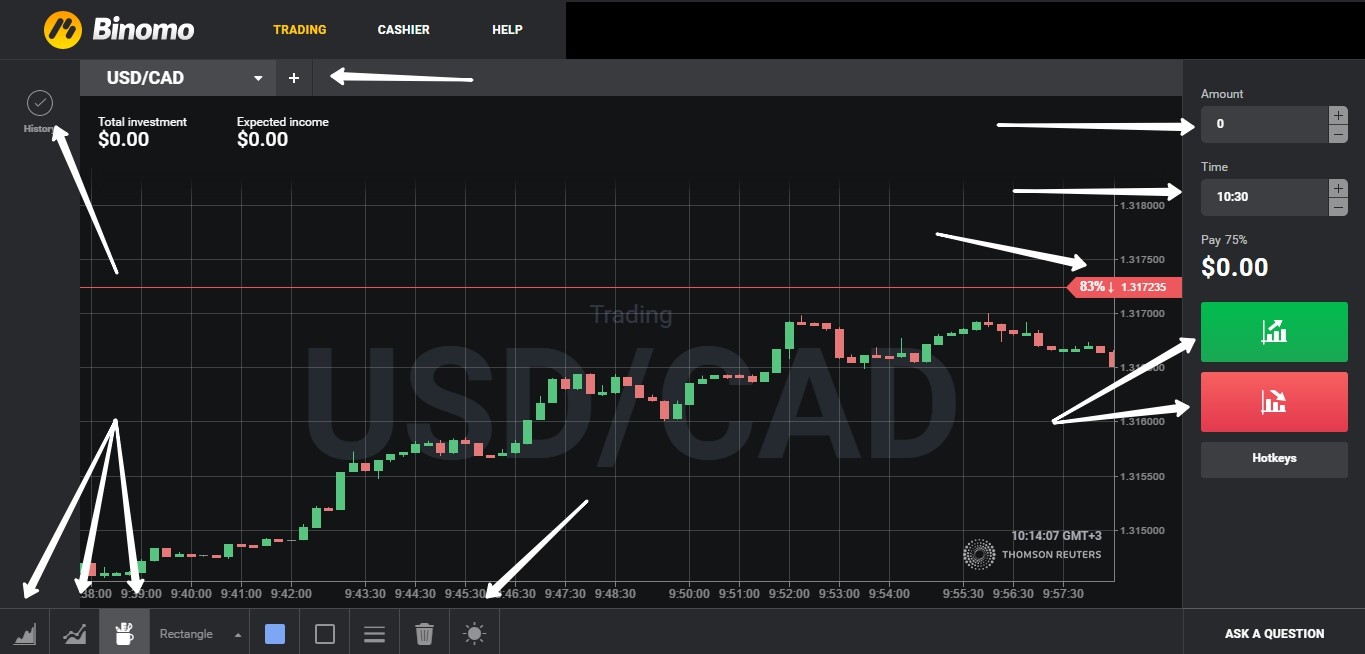

- And, thirdly, pay attention to the trading platform offered by the broker for trading binary options. Often, “kitchens” do not invest in new development. Their goal is simply to get rich quick at your expense and with minimum investment. If the broker’s trading software doesn’t have informational content or additional functions, or if it’s a stripped-down version of a popular trading platform, you are clearly on the site of an dirty broker. Normal brokers, like Binomo, care about their clients and the profitability of their trading, so they do their best to develop new service products. Here is a proper broker trading platform:

To summarize, a brokerage company is an intermediary between the client and the financial market that has legally regulated access to financial transactions on stock exchanges. Therefore, the use of broker services by private traders is a necessity due to the financial and legal difficulties for an individual to obtain a broker license. And when choosing a broker, you should clearly examine all the available information about the company, so as not to fall into the hands of fraudsters.